-40%

THE UTIMATE TAX BIBLE FOR SELF-EMPLOYED ENTREPRENEURS BY ALBERT AIELLO - 12 CDS!

$ 145.19

- Description

- Size Guide

Description

LEGAL TAX STRATEGIES& TAX SECRETS!

The Ultimate Tax Bible

For Self Employed Entrepreneurs

By Albert Aiello CPA,

RE Investor

Contains OVER

200 Little-Known, Brilliant & Updated Tax Reduction Strategies!

Updated CD Series!

The Ultimate Tax Bible For Small Businesses, Hame-Based Enterprises & Independent Contractors

Save ,000’s Of Dollars In Taxes Every Year Without IRS Problems and Without Having To Pay High-Priced Tax Advisors!

Total Package Includes:

10 Total Audio CD's

&

Bonus

The Bible CD-Rom Forms Disk

& Medical Reinbursement Plan Forms Disk

The Ultimate Tax Bible for

Self-Employed Entrepreneurs

By Albert Aiello CPA, RE Investor

Package includes: 10 Course Audio CD's, The Bible CD-Rom Disk Forms CD & Bonus Medical Reimbursement Forms Kit.

Condition: Used - Guaranteed to play!

Copyright: 2008

The Ultimate Tax Bible For Self-Employed Entrepreneurs

______________________________________

Al Aiello, CPA, MS Taxation, Business Owner

As author of The Renaissance Goldmine of Brilliant Tax Strategies For Real Estate Investors, Al Aiello also has created this special tax course with different strategies targeted to business owners. This equals even more savings in your pocket.

All self-employed and home-based businesses (including real estate investors) will profit from this course!

All types of entities - Schedule C, partnerships, corporations, LLC ‘s.

A partial list of the money-saving gems you will discover…

200+ Little-Known, Brilliant & Updated Tax Reduction Strategies!

Any one of these can save you hundreds even thousands!!

7 Proven Tax Tips You Must Know to Forever Cut Taxes

How To Deduct Almost Everything You Pay... With over 250 Deductions! You will become a walking tax deduction!

18 Ways to Audit Proof Your Business Returns… Let IRS Forget You and your wallet! AVOID the costs, time and aggravation of an audit!!

The Right Entity for Your Business That Saves You The Most Taxes!

17 Ways to Write-off ,000’s of Capital Assets -- All in One Year!

19 Ways to MAX Auto deductions…”Drive” away your taxes!

Is Leasing an Auto Really Better? When you should, or should NOT!

Deduct Your Vacations > Let the IRS Pick Up The Tab!

13 Ways to Deduct Entertainment ...Profit & Have Fun While Doing It!

Use Your Own HOME to Generate Tax Savings – Sleep while you save!

How to safely claim Home-Office Deductions – not a red flag…If you do it RIGHT!

Hiring Assistants - 9 Ways to Save Costly Payroll Hassles

Use Family Members to make your business grow and Lower Your Tax Bill!

Deduct 100% of Medical Deductions as Business Expenses

36 Ways to Maximize Valuable Business Deductions

9 Ways to Create Wealth With Retirement Plans … Tax-Free!

Reduce Those Killer Social Security Taxes from eating up your income!

Lower Your Quarterlies… You Keep The Interest!

Find Hidden Tax Dollars from the Past...Let the IRS Make You Rich!

Contains Many Tax Gems Even the Best Tax Advisors Do Not Know!

Much much more!

“This is a course you must have if you plan on being in business. The plain language explanation of these tax reduction strategies should be required reading for all self-employed entrepreneurs” - Allan Domb, Top Producing Realtor, Center City Philadelphia

UPDATED AUDIO SERIES!

10 Audio CD's

Here's What's On the CD's!

( Some topics can be worded different)

CD 1:

Track 1: Start Off On The right Foot

Track 2: Great Tax Advantages Of A Business

Track 3: How To Maximize Depreciation Deductions In Your Business

Track 4: Huge Upfront Deductions With First-Year Expensing

Track 5: Other Depreciation Deduction Strategies To Save You More

CD 2:

Track 1: Strategies To Maximize Auto Depreciation

Track 2: Auto Deduction Methods With Strategies

Track 3: Standard Auto Mileage Method

Track 4: Actual Method of Deducting Auto Expenses

Track 5: Strategies To Increase Business Miles And Deductions

Track 6: Should I Lease Or Buy, Which Is Better

CD 3:

Track 1: Strategies To Maximize Entertainment

Track 2: Strategies To Maximize Out-Of-Town Travel

Track 3: Strategies To Maximize Home-Office Deductions

CD 4:

Track 1: Save Payroll Taxes With Independent Contractors

Track 2: Deducting Family Members As A Business Expense

Track 3: Fringe Benefits - More Family Deductions

Track 4: More Family Tax Strategies Via Leasing

CD 5:

Track 1: Advantages And Types Of Retirement Plans

Track 2: Qualified (Keogh) Plans

Track 3: SEP Plans And SIMPLE Plans (best kept secret)

Track 4: Retirement Plan Strategies

Track 5: IRA’s - Traditional And Roth Plans

Track 6: How To Take Out Tax-Free Money From IRA’s And Other Tips

CD 6:

Track 1: Fully Deduct Business Tax Losses Even With No Income

Track 2: Strategies To Maximize Deductions On Business Schedules

Track 3: How To Audit-Proof Your Business

Track 4: Audit-Proofing Statements

Track 5: Advantages and Strategies For Filing Extensions

CD 7:

Track 1: Using An S-Corp To Save On Social Security Taxes

Track 2: Using An S-Corp With A Medical Reimbursement Plan

Track 3: Other Tips To Reduce Social Security Taxes

Track 4: Other S-Corp Planning Tips

Track 5: C-Corporations- When To Use, When Not To Use

Track 6: Using An LLC For Your Business

CD 8:

Track 1: Strategies For Loss-Years, Including NOL’s For Refunds

Track 2: Lower Your Quarterly Estimates Without Penalties

Track 3: Safely Filing Amended Returns For Hidden Tax Dollars

Track 4: How To Select The Right Tax Advisor For Your Business

CD 9:

Track 1: Overlooked Business Deductions (And Savings)

Track 2: Year-End Tax Planning Strategies (Up To December 31)

Track 3: Why Are You Paying Too Much Taxes And What To Do About It

CD 10:

Using the tax law to make your wealth Case Study – How a self-employed professional use a simple 6 step plan to save over ,000 in only taxes every year!

ALSO BONUS

1. The Bible CD-Rom Disk

2,. The Bible Forms CD & Medical Expenses Forms CD

......................................................................................

My items I sell are either brand new, My personal items, acquired at Estate sales or from previous owners contacting me to sell their items.

This is a Real Estate course and/or other media items. For this reason please understand there are No Refunds. If You are not sure what you are buying please don't buy it. Thank you for understanding.

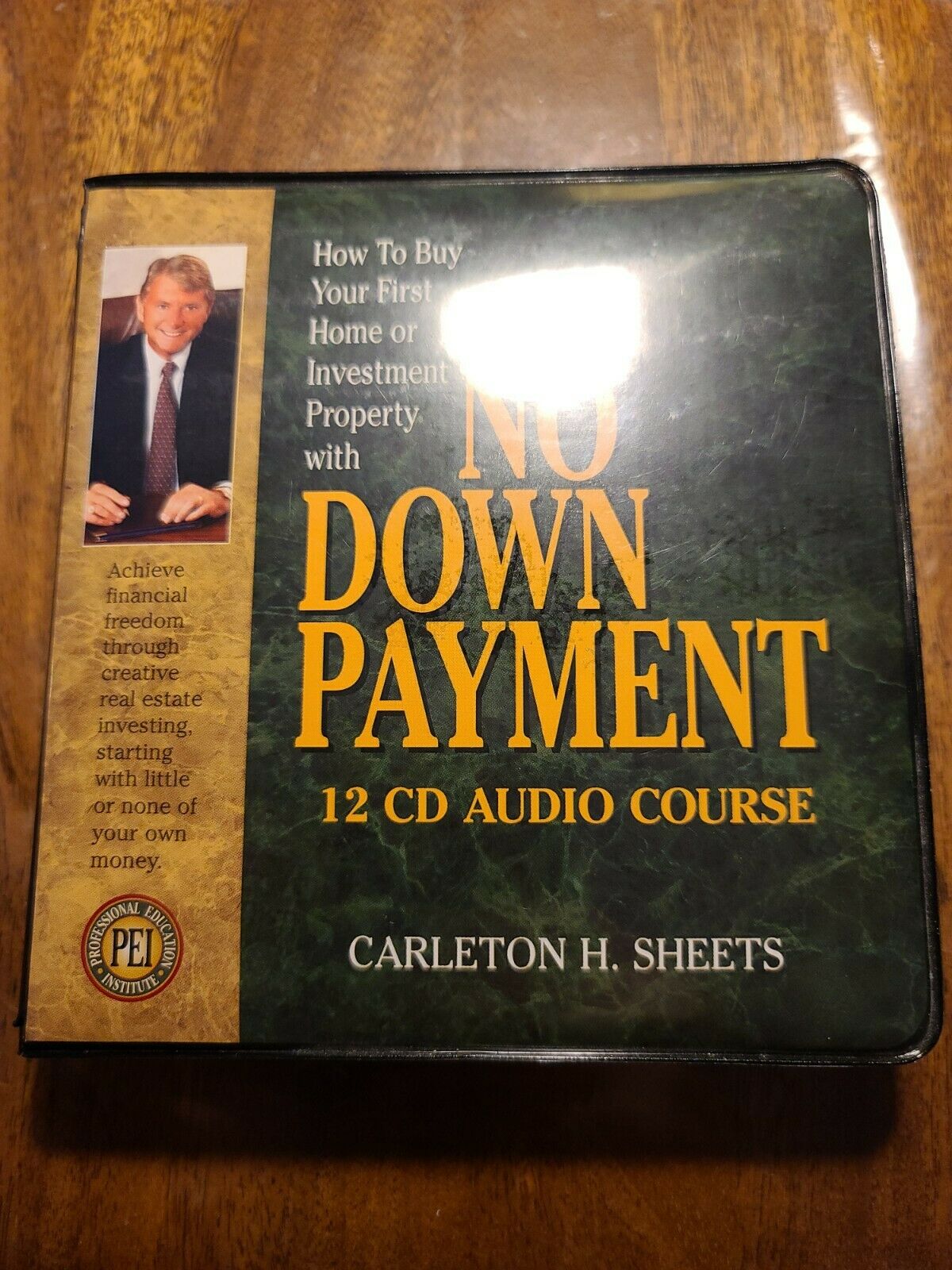

Picture is of actual items.

Check out all of my Motivational & Success DVD and CD collections!

My entire store is on sale!! New stuff added daily!

For International see shipping above.

If you should have any questions please ask me.

PAYMENT:

PAYPAL ONLY

. PAYMENT IS EXPECTED WITHIN TWO DAYS OF THE END OF AUCTION. AT THIS TIME , THE ITEM WILL BE RELISTED, IF PAYMENT HAS NOT BEEN RECEIVED.

BUY IT NOW:

IMMEDIATE PAYMENT IS REQUIRED WITH ALL ITEMS BOUGHT WITH THE

" BUY IT NOW "

OPTION.

SHIPPING:

I SHIP MY ITEMS THROUGH USPS . WHEN USING USPS ITEMS WILL BE SHIPPED EITHER MEDIA MAIL, FIRST CLASS MAIL OR PRIORITY MAIL UNLESS SPECIFIED OTHERWISE . ALL SHIPPING FEES INCLUDE AT NO EXTRA CHARGE DELIVERY CONFIRMATIONS.

SHIPPING

IS FOR THE

LOWER 48 STATES ONLY

.

ALASKA

AND

HAWAII

& ANYWHERE IN CANADA PLEASE CONTACT ME FOR SHIPPING COST BEFORE BIDDING.

COMBINED SHIPPING:

I DO COMBINE SHIPPING ON MULTIPLE ITEMS WON AT YOUR REQUEST. IF YOU WANT SHIPPING COMBINED PLEASE CONTACT ME AND I WILL PROVIDE YOU WITH THE SHIPPING COST . THERE ARE RARE CASES WHEN COMBINED SHIPPING WILL NOT BE POSSIBLE.

SHIPPING TIME:

THE SOONER YOU PAY FOR YOUR ITEM , THE SOONER YOU WILL RECEIVE IT .

I GUARANTEE YOUR ITEM WILL BE SHIPPED WITHIN 24 HOURS AFTER I RECEIVE PAYMENT. ( EXCEPT FOR E-CHECKS , WITH AN E-CHECK I HAVE TO WAIT TILL YOUR PAYMENT CLEARS)

REFUNDS OR EXCHANGES:

I STRIVE FOR 100 % CUSTOMER SATISFACTION! A LOT OF MY PRODUCTS ARE VINTAGE & HARD TO FIND COLLECTIONS AND BRAND NEW OR USED MEDIA PRODUCTS LIKE AUDIO (CASSETTES , CD's OR DVD's) SO WE CANNOT OFFER REFUNDS OR EXCHANGES FOR THAT REASON. THANK YOU FOR UNDERSTANDING. PLEASE CONTACT ME WITH ANY PROBLEMS.